- #Does bitpay report to irs series#

- #Does bitpay report to irs download#

- #Does bitpay report to irs free#

This Section requires payment processors to provide information to the IRS through Form 1099-K reporting. Holding Cryptocurrency in a Paper Wallet Can I claim crypto losses on taxes? If you receive a Form 1099-B and do not report it, the same principles apply. Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we'll calculate your capital gains. Do you report my purchase of Precious Metals to the IRS? Kraken does not report unless they are asked to provide information on a specific person due to a legal investigation.

#Does bitpay report to irs free#

You can also see if Coinbase has issued any forms about you to the IRS.įor more info on crypto tax basics, visit our Crypto Tax Guide.Portfolio tracking on the platform is free to users who only need basic functionalities, and is available to customers with a broader set of needs starting at $14 a month.For U.S.-based users with relatively simple crypto holdings, an annual tax plan with CoinTracker is free.

#Does bitpay report to irs download#

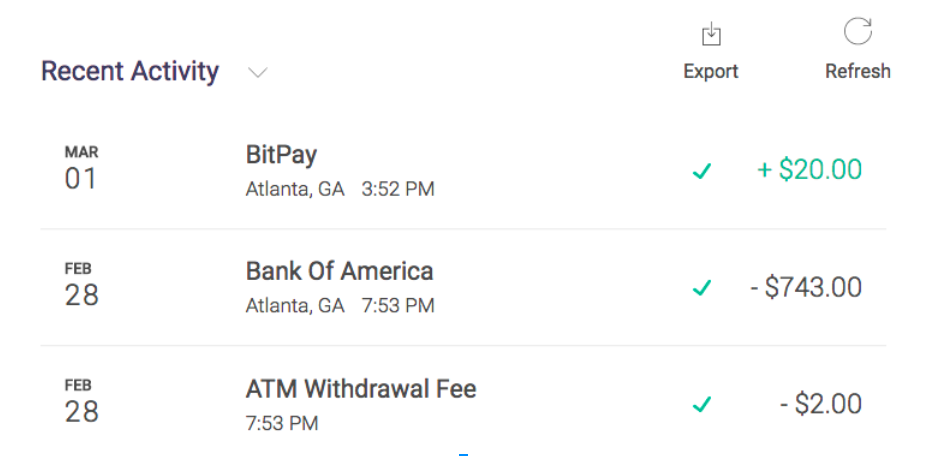

Here you can download gain/loss reports and raw transaction history CSVs.

However, if you need to download a copy of your transaction history for record-keeping or your accountant, you can do so by visiting the Taxes section of your account. Many crypto tax calculators, TokenTax included, can sync to Coinbase via API so that transaction history is automatically imported and updated. Accessing your Coinbase tax documentsĮven if you don't receive a 1099-MISC from Coinbase, you need to report any income or capital gains/losses you've realized on the exchange. To address such misunderstandings usually requires the intervention of a crypto CPA.Īlthough IRS misinterpretations of the 1099-K are typically resolved, their effect on customers was burdensome enough to prompt Coinbase and some other crypto exchanges to stop sending these tax forms. This may result in the IRS sending CP2000 letters, which inform filers they may have significantly under-reported their income on their tax filings. Agents sometimes interpret 1099-K calculations as crypto traders’ profits, rather than their trades’ volume. This situation can lead to confusion at the IRS.

#Does bitpay report to irs series#

Despite the fact that this series of transactions represented a 25 cent loss, $1.75 would be reported as part of the amount on the 1099-K. However, because Form 1099-K reports the aggregate amount of crypto involved in an individual’s trades, rather than the net profits or loss, it was easy for transactions that ultimately represented a loss to be interpreted as generating revenue.įor example, imagine you purchased a token for $1.00, but sold it later in the same year for only 75 cents. Why did Coinbase switch from Form 1099-K to Form 1099-MISC?īefore 2021, Coinbase sent Forms 1099-K. For more information on the 1099-MISC visit our blog about cryptocurrency Form 1099s. A crypto tax calculator can help with this. You are required to report the details-as well as any crypto capital gains, losses, or ordinary income from any exchange-in order to calculate your crypto taxes.

The 1099-MISC doesn’t report individual transactions from staking or rewards, just your total income from them. What do I need to do if I receive a 1099-MISC from Coinbase? Previous years’ 1099-K and current 1099-MISC data helps the IRS identify filers who may be failing to report or under-reporting. They are sending letters 6173, 6174, and 6174-A or even CP2000 notices. In recent years, the IRS have increased their crypto tax audits and enforcement. This form signals to the IRS that a user is actively trading crypto and may have transactions other than rewards or staking to report.

The 1099-MISC tax document does not report crypto capital gains or losses, but that doesn't mean you don't need to report them. Thus, if you have received a 1099 form from Coinbase, so has the IRS-and they’ll be expecting you to file taxes on your cryptocurrency income.

The exchange sends two copies of each cryptocurrency tax form: One to the taxpayer and one to the IRS. Note that these tax forms do not report capital gains or losses. traders and made more than $600 from crypto rewards or staking in the last tax year. Currently, the exchange sends Forms 1099-MISC to users who are U.S.

0 kommentar(er)

0 kommentar(er)